If you are a small business owner or consider starting a business in Spain you will need to have proper accounting and file tax returns quarterly.

There are several forms of business entities in Spain which are similar to many European countries. One of the most popular ones are to be Autonomos where you often have reduced fees for social security the first years and is fairly simple way to start a business.

When you register your business you will need to pay social security, income taxes and VAT just like in your country of origin.

We are happy to help you getting started, keep your accounts and file your taxes. Please do get in touch for more information.

In general taxes for businesses are in lin with other European countries. How much you have to pay depends on the type of company, the business activity and the deduccions you can make.

Please get in touch and we will give you an idea of your tax situation.

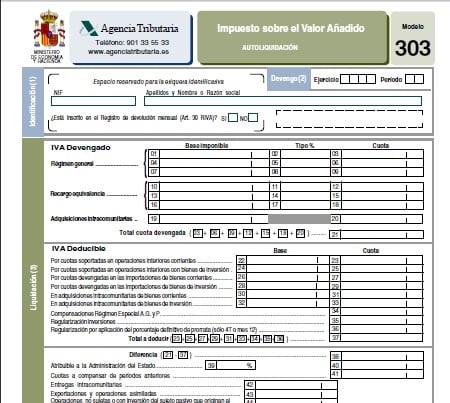

Modelo 303 is the Spanish tax form for declaring VAT = IVA quarterly. This is one of the most common tax returns a small company needs to file in Spain. We will help you with IVA, corporate income taxes as well as any social security payments you may need to pay.

Other common forms are Modelo 130 for quarterly preliminary taxes as Autonomo and 036 to register your business activity.

Please get in touch and we will guide you through various tax forms and registrations.

If you operate business activity in Spain you are obliged to pay taxes in Spain for this activity. The tax regime is quite favourable for small and medium sized businesses.

VAT needs to be declared quarterly but there are also yearly corporate income taxes. There are several aspects that effect which taxes you need to pay and when, please do contact us for more information.

info@taxadora.com

If you business activity is conducted in Spain you will also need to pay taxes in Spain. If you company is registered outside of Spain your tax obligations will differ in some aspects from Spanish registered companies.

Please get in contac with us if you are unsure about your tax obligations as a business owner.

Conducting business acitivities in Spain without proper accounting and paying taxes can lead to heavy fines or other sanctions. This is not recommended.

If you wish to reach us by chat, you can go to www.facebook.com/taxadora/

Wenn Sie uns telefonisch erreichen möchten, können wir einen Termin vereinbaren. Bitte kontaktieren Sie uns unter info@taxadora.com, um einen Termin zu buchen.

Wenn Sie uns per Chat erreichen möchten, besuchen Sie bitte www.facebook.com/taxadora/

Als u ons telefonisch wilt bereiken, kunnen we een afspraak maken. Neem contact met ons op via info@taxadora.com om een tijdstip te boeken.

Als u ons via de chat wilt bereiken, kunt u naar www.facebook.com/taxadora/

Si vous souhaitez nous joindre par téléphone, nous pouvons fixer un rendez-vous. Veuillez nous contacter à info@taxadora.com pour convenir d’un horaire.

Si vous souhaitez nous joindre par chat, vous pouvez visiter www.facebook.com/taxadora/

Om du vill nå oss via telefon kan vi boka en tid. Kontakta oss via

info@taxadora.com för att boka en tid.

Om du vill nå oss via chatt kan du gå till

www.facebook.com/taxadora/