You fill in your tax details on our site in less than 5 minutes.

If you have any questions we will guide you through phone, chat or e-mail.

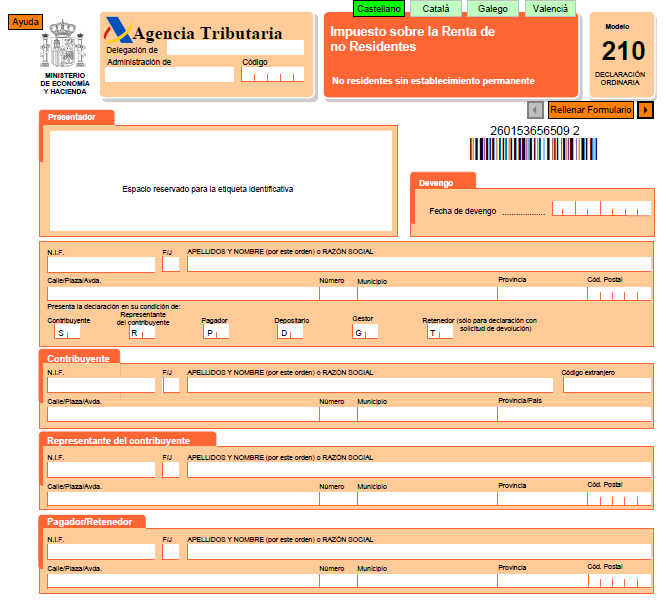

We calculate your tax, make sure that the information is correct and send your tax declaration to the spanish tax authority.

We set the tax payment on direct debit and you do not have to go to the bank.

You will receive your tax return from us and the tax will be collected by the Spanish tax authority from your Spanish bank account via direct debit.

You fill in your tax details on our site in less than 5 minutes.

If you have any questions we will guide you through phone, chat or e-mail.

We calculate your tax, make sure that the information is correct and send your tax declaration to the spanish tax authority.

The tax payment will be set on direct debit and you do not have to go to the bank.

You will receive your tax return from us and the tax will be collected by the Spanish tax authority from your Spanish bank account via direct debit.

If you have sold a property in Spain you have propably noticed that you only got paid 97 % of the sell price.

This is the Spanish tax authorities way of collecting tax from foreigners selling property in Spain.

When you sell a property you are obliged to declare the sale and if you have not made a capital gain you will receive the 3 % of the sale price which the buyer has paid on your part to the tax agency.

If you have made a capital gain you are obliged to pay capital gains taxes in Spain.

Please continue reading below for more about capital gains taxes in Spain.

Capital gains tax in Spain for Non Residents living in the European Union is 19 %.

If you live in the UK or elsewhere outside the European Union the tax rate is 24 %.

The tax is based on the profit you have made after deducting costs.

Repairs are seldom deductible, if you are unsure, please do contact us for more information.

Repairs/renovations are seldom deductible, if you are unsure, please do contact us for more information.

Modelo 211 is a tax form filed by the buyer of a Spanish property if the seller is a foreigner.

It is filed when the buyer pays a 3 % withholding/retention on the sellers behalf to the tax agency. When the seller declares a capital gain/loss this 3 % will be available for the seller as partial payment of the tax or as a tax refund.

Please do ask your buyer or their lawyer for the tax form 211, you will need it when you declare your sale.

When you sell a property in Spain as a foreigner, the Spanish tax agency makes sure you pay your fair share of taxes.

The way they do this is by making it mandatory for the buyer to pay you only 97 % and pay 3 % directly on your behalf to the tax authorities.

When you declare your sale you will be able to use this 3 % as a partial payment of your capital gains tax and if you have not had any capital gain you will be able to reclaim the amount.

We are happy to help you reclaim the 3 % and file your spanish tax return.

It is mandatory to file a capital gains/loss tax return when you sell a property even if the 3 % is already paid.

In Spain you have to pay taxes to various levels of government. The capital gains tax is paid to the state tax agency Agencia Tributaria but there is also a local, municipal tax on “increase on land value” which has to be paid when a property is sold.

In most cases this is paid by the seller but if the seller is a foreigner the tax is often paid by the buyer. The amount is often deducted from the sale price in the deed. This means that most times you do not have to declare Plusvalia as a foreigner since the buyer has already done it.

The reason is that if a foreign seller leaves the country without paying it, there is little that the municipality can do. They do not have the same resources to chase people avoiding taxes as the state tax authority who are very good at it.

Modelo 600 is the tax form used for property transaction taxes paid by the buyer.

As a seller you do not have to worry about this. In most cases the buyers lawyer or gestor arranges this tax.

It is recommended to solicit professional help when filing a capital gains tax in Spain.

Many Spanish law firms offer this service but they tend to be quite expensive and it is often not their favourite activity since they often prefer to focus on the purchase process of properties.

If you need our help to file the tax return we are happy to help you. Our fee for one owner is 198 € plus VAT and for two owners 248 € plus VAT.

We will prepare your tax return, file it and give you advice along the process. If you have missed earlier taxes our fee includes help answering letters from Agencia Tributaria.

To get started, please click on the red button.

If you have sold a property in Spain you will need to declare capital gains taxes from the sale.

When you sold the property you have propably only received 97 % of the sale amount from the buyer. This is the Spanish tax agencys way of collecting tax from foreigners and avoiding non-payment of taxes. The additional 3 % can be returned to you when you submit a capital gains tax declaration.

You normally have 3 months to file the tax return from the time of registering the sale. The registration may take a month so the total time can be up to 4 months.

If you have missed to file your tax return, please do contact us and we will help you. It is always better to declare the tax late even if you have missed a deadline.

Yes, you must declare in both countries.

When you sell a property in Spain this is always taxed in Spain while you will probably also have to pay capital gains taxes in your home country because you are living there.

According to most tax treaties Spain has signed, the capital gains tax paid in Spain is deductible in your home country.

If you have never declared although you should have done so, we recommend to declare retroactively four years back in time, which is the period that the Spanish tax authority usually goes back to claim unpaid taxes.

The sale of a property usually wakes up the Spanish tax authorities so if you have never paid you should declare immediately before they send you a letter (with sanctions).

You may have to pay a penalty for the years you missed but fortunately there are discounts for this if you choose to declare the years you missed. Please contact us for further information.

There are stories online and among friends about people who never bothered to declare and nothing has happened. However, this is not correct and very risky since the Spanish tax authority has access to both Spanish property registers and European tax information through a joint tax register in the EU. It can easily get expensive with sanctions and they will track down assets in your home country.

Also, note that there are “discounts” on the fines if you choose to declare earlier years when you missed.

When you sell a property you can file a joint tax return declaring the capital gain/loss of both.

This is the only occasion when Non-Residents can file a joint tax return in Spain.

If you wish to reach us by chat, you can go to www.facebook.com/taxadora/

Wenn Sie uns telefonisch erreichen möchten, können wir einen Termin vereinbaren. Bitte kontaktieren Sie uns unter info@taxadora.com, um einen Termin zu buchen.

Wenn Sie uns per Chat erreichen möchten, besuchen Sie bitte www.facebook.com/taxadora/

Als u ons telefonisch wilt bereiken, kunnen we een afspraak maken. Neem contact met ons op via info@taxadora.com om een tijdstip te boeken.

Als u ons via de chat wilt bereiken, kunt u naar www.facebook.com/taxadora/

Si vous souhaitez nous joindre par téléphone, nous pouvons fixer un rendez-vous. Veuillez nous contacter à info@taxadora.com pour convenir d’un horaire.

Si vous souhaitez nous joindre par chat, vous pouvez visiter www.facebook.com/taxadora/

Om du vill nå oss via telefon kan vi boka en tid. Kontakta oss via

info@taxadora.com för att boka en tid.

Om du vill nå oss via chatt kan du gå till

www.facebook.com/taxadora/