You fill in your tax details on our site in less than 5 minutes.

If you have any questions we will guide you through phone, chat or e-mail.

We will calculate your tax, make sure that the information is correct and send you a draft before we submit it to the tax authority.

When you are satisfied we file the tax return to Agencia Tributaria.

The tax payment will be set on direct debit and you do not have to go to the bank.

You will receive your tax return from us and the tax will be collected by the Spanish tax authority from your Spanish bank account via direct debit.

You fill in your tax details on our site in less than 5 minutes.

If you have any questions we will guide you through phone, chat or e-mail.

We will calculate your tax, make sure that the information is correct and send you a draft before we submit it to the tax authority.

When you are satisfied we file the tax return to Agencia Tributaria.

The tax payment will be set on direct debit and you do not have to go to the bank.

You will receive your tax return from us and the tax will be collected by the Spanish tax authority from your Spanish bank account via direct debit.

Updated 15/05/2024.

If you have decided to let your property in Spain and receive Rental Income you are obliged to file a tax return every quarter if you are Non-Resident in Spain.

This means that you spend less than half the year in Spain and normally pay taxes in another country. If you are a Resident, please click here to go to our page for Residents taxes.

We can help you to declare your Rental Income Taxes in Spain easily.

You just need to send us information about:

We will verify the information and calculate your taxes and send you a draft. When you are happy with the calculation, we file the taxes and set up direct debit for the payment of the tax so you do not need to go to a Spanish bank physically to pay the tax.

We will offer you advice and guidance along the way, for example about deductions which will lower your tax amount. If you have any questions, for example about deductions, you can always reach us by e-mail or phone,

When you use your property for own purposes apart from renting it, you are also obliged to declare “imputed income tax” for the property once a year. We are also happy to help you with your yearly Non-Resident Income Tax Return for the days you have used the property for your own needs. Please click here to read more about the imputed tax – NRIT.

Please continue reading below and we will explain Rental Taxes for Non-Residents in Spain

The tax rate depends if you live within the EU or outside. For EU nationals the tax rate is 19% of the taxable amount and you can make deduccions.

If you are not a EU national, the tax rate is 24 % and you can not make any deduccions.

When you can apply deduccions as EU national, the tax is usually around 10-15 % of the rental income after we have made all the applicable deduccions.

The part of the year you do not rent your property you will need to pay an “imputed tax”.

You can usually claim back the Spanish tax in your own country if you have also paid taxes for the rental income in Spain in your country of origin.

No, we do not have access to your bank account, only the Spanish tax authority can charge your account through direct debit.

You pay our fees through a debit/credit card. You can read more about our fees on this page.

Yes, if you are living within the EU you can deduct costs you have had for obtaining the rental income. If you live outside the EU, please send us an e-mail and we will advice you.

After the deduccions your rental income taxes in Spain usually are around 10-15% of the rental income.

You can usually deduct all costs that are directly related to the income you have received.

The costs have to be proportional to the income received during the year and you might need to amortize some costs.

There are also general allowances related to the property value which can lower your tax considerable.

If you let your apartment on a long term basis with the purpose being to create a permanent resident of the tenant you might also be able to do an additional reduccion of 60 % of the taxable amount.

Getting the deduccions right can be very complicated in Spain, especially if you have made renovations and want to deduct costs.

Please contact us if you have any questions and don’t worry, we will make sure you get all the deduccions you are entitled to.

Yes, but you need to make sense of a rather difficult Spanish tax system. Rules also change, tax forms can differ from year to year.

There might also be problems with bank payments or the property values might have been revised between years. The advice you might have found on internet might not be correct and the advice your lawyer or gestor gave you a few years ago might be out of date.

The good thing about our service is that you won’t have to worry about that and you have access to support if you have any questions.

We like the analogy that sometimes it’s comfortable to go to a restaurant even if you know how to cook. You won’t need to worry about finding a new recipe or doing the dishes.

But hey, if you love cooking, or doing taxes, you can always spend a few hours making a mess in the kitchen.

We have also sometimes clients saying that they don’t have any deduccions to make and when de discuss it with the client we always find deduccions worth more than the cost of the service.

Your Valor Catastral is your spanish tax-value of the property. You can find it on your IBI-payment receipt (the municipal property tax). It is Valor Castastral Total which we neeed. I can be also called Valor Catastral / Base Imponible on your IBI-receipt.

If you have a newly build house the Valor Catastral might not yet be assiened. In this case, please contant us for more information, info@taxadora.com.

You can also take a foto of your IBI-payment, send it to us and we find it for you,

Please click here to find more about IBI and Valor Catastral.

Please contact us and we will find out why. Sometimes this might be due to the fact that your bank has registered your account with the passport number and not your NIE number. This prohibits the tax authority to make the payment. It can also be that the bank has missspelled your NIE or that one of the owners of the property is not account holder “titular”.

It is important that the account holder is the person who is the owner of th property. If you are a couple, make sure that the account is in the name of both owners.

You also have the possibility to make the payment to our client account and we make the payment directly. This can be an opcion if only one of you is stated as account holder for the bank account or if you are near a deadline and there is no time to set up direct debit.

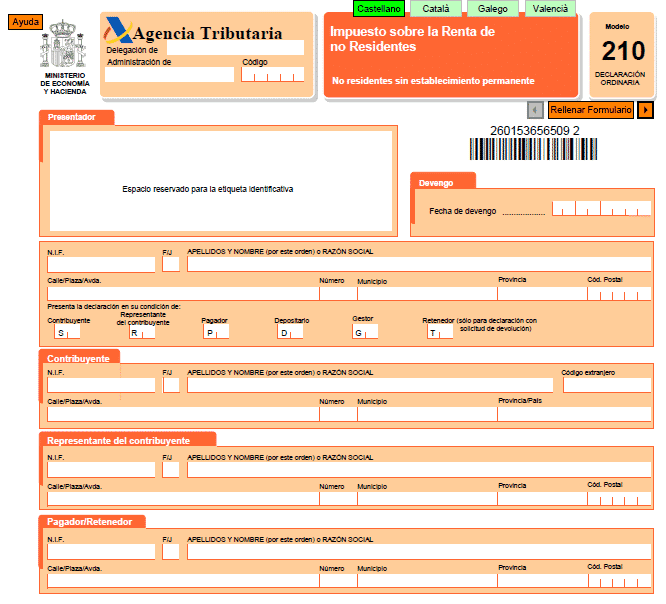

Modelo 210 is the Spanish tax form for Non-Residents. It is obligatory for persons who own a property in Spain but normally reside in another country (more than 183 day a year).

In the form you will need to declare for the days you have used your property yourself and to declare any rental income taxes in Spain.

You can read more about it on this link.

If you own a property in Spain, you must declare it in Spain whether you are tax-registered in your home country or Spain.

It reality it is an income tax paid to the state and now you might think “but hey, I do not have any income in Spain, why do I have to declare?” Well the simple answer is that the Spanish state sees owning a holiday home as an “imputed income”, or a benefit which you enjoy and therefore need to pay tax. You could also see it as a type of “state property tax” you pay.

If you also rent your property you will need to use the form to present your rental income taxes in Spain.

Apart from Modelo 210 and the Non-Resident Income Tax “NRIT”, you will also need to pay a local property tax called IBI to your municipality. You do not need to declare this, but the municipality automatically deducts it after you are registered as the owner of the home. In most cases your lawyer will set it up as a direct debit when you buy the property and they help you change your electricity and water contracts.

Now let’s look at when to do all this!

From 2024 onwards, rental income must be declared annually. Until 2023, rentals were declared quarterly in the current year.

The deadline for the declaration for payment by direct debit for 2024 income is now 15 January 2025.

In general, it is a good idea to start collecting invoices towards the end of the year so that everything is available immediately after the end of the year and send us all the information as soon as possible so that there is time to sort out any issues.

If you missed previous years’ rental income, quarterly declarations still apply to these. That is, if you rented out in 2024, a declaration at the beginning of 2025 is sufficient, but if, for example, you rented out 3 quarters in 2022 that you missed declaring, you still need to submit 3 separate declarations for 2022.

For the period you have not rented out the property, you need to declare a standardised tax annually. The flat-rate tax must be declared by the end of December, the year after the tax year. This applies if you do NOT rent out your home. That is, if you are liable for tax in 2023, you will declare in 2024 and your tax will be deducted from your account at the end of December 2024.

If you are a permanent Resident, you should file your tax return between April and June. Keep in mind that you need to declare foreign assets already by the end of March.

But what happens if I already pay tax in another country?

If you let your property to a physical person who will use it as a home you do not have to add VAT.

If you let it to a company or a person who will use it for professional purposes such as an office you should add VAT.

If you let it to a company who will sublet it as a holiday home you might have to add VAT. The company might also be obliged to make a tax retention on your behalf and prepay your Non Resident tax to the tax authority. In this case you can file a tax return to reclaim excess taxes.

If you provide additional services while letting it to physical persons, such as breakfast you might have to add VAT.

Yes, you must declare any rental income received in Spain in both countries if you are Non-Resident. In Spain you declare your Spanish property even if you are tax resident in other country normally.

If you have rental income, you must declare these in both your home country and Spain and make deductions according to the respective countries’ tax system.

You can then claim the Spanish tax back in some cases under double taxation agreements so that you do not have to pay double tax.

If we compare that to the rental income received (285/2500) you can see it will be around 11,4 %.

We declare that and you pay 285 euros to the Spanish Tax agency.

At the same time you are resident in a EU country, for example Sweden.

Since the tax allowances in Sweden are more generous than in Spain, you would not pay in rental income tax in Sweden for your Spanish property. You will only pay the Spanish tax of 285 euros.

Since you have paid more tax in your home country than in Spain you could claim back tax so your total tax will not exceed 600 euros. In which country you claim back your tax depends on the double taxation agreement between your country and Spain. In general this always means that you pay the amount which is the highest between the countries.

If you have never declared although you should have done so, we recommend to declare retroactively four years back in time, which is the period that the Spanish tax authority usually goes back to claim unpaid taxes.

You may be able to pay a penalty for the years you missed but fortunately there are discounts for this if you choose to declare the years you missed. Please contact us for further information.

Now let’s look at what might happen if you do not pay!

There are stories online and among friends about people who never bothered to declare and nothing has happened. However, this is erroneous and very risky since the Spanish tax authority has access to both Spanish property registers and European tax information through a joint tax register in the EU. It can thus be expensive and come at the same time as you simply become a tax saver and break the law.

In general the Spanish tax agency is more lenient when you choose to pay late taxes than when they discover you have not paid and they “get you caught”.

Also, note that there are “discounts” on the fines if you choose to declare earlier years when you missed.

Yes, you both need to declare rental in Spain separately.

Rental income must by law be declared separately per owner and per property if you own several properties as long as you are Non-Resident.

The declarations must be submitted quarterly. If you are a Resident, an annual declaration will suffice when you file your income taxes.

A few years ago, non-residents would declare separately PER TENANT!

Some lawyers / gestors / advisors say that it is enough to declare one person, which means that they can offer lower prices as they only do half the job. This is not according to law and our recommendation is not to do it this way. If you have any further questions about this feel free to email us at info@taxadora.com.

Yes! You have to. It is considered a taxable benefit for owning a second home. See it as a state property tax. You do not have to pay rental income taxes in Spain but you will have to pay a yearly “imputed tax”.

Yes, you must declare both income in your home country and rental income taxes in Spain. You deduct according to the respective country’s rules and then can claim back the Spanish tax under the double taxation agreement.

You request a tax residency certificate from your home country tax agency. It is a certificate issued by the Tax Agency to certify that you have your tax residence in your country. This means that you are liable to tax in Spain only as a “non-resident” and only pay tax on the assets and income you receive from Spain.

Normally, you need to submit a tax residence certificate the first time you declare your rental income taxes in Spain. It may also happen that the tax authority demands this. Then you must apply for one on the your home country´s Tax Agency which shows that you are liable to tax in your home country.

No, you do not normally need to send in your invoices to us. Modelo 210 is a preliminary declaration stating the income you have had and the costs you feel you are entitled to deduct. If the tax authorities make a different interpretation or request receipts, you will hear from them and then it is important that you have receipts that are approved.

Please do not that you need proper invoices with NIE nr, name and VAT number. The Spanish tax authority is very strict with receipt formalities in their hunt for undeclared incomes.

If you let your property to a company, the company is obliged to make a tax retention on your behalf.

If you live in the UK or outside of EU your retention amount will be 24 % and you are not obliged to file a tax return for rental income. Since you can not deduct any expenses after Brexit there is no reason for you to file the tax return.

If you live in the EU, the company will make a retention of 19 % and you are allowed to deduct costs so in reality your tax will be lower. You should file a tax return to reclaim the difference between 19 % and the real tax you ought to pay which is less after the deductions.

If you wish to reach us by chat, you can go to www.facebook.com/taxadora/

Wenn Sie uns telefonisch erreichen möchten, können wir einen Termin vereinbaren. Bitte kontaktieren Sie uns unter info@taxadora.com, um einen Termin zu buchen.

Wenn Sie uns per Chat erreichen möchten, besuchen Sie bitte www.facebook.com/taxadora/

Als u ons telefonisch wilt bereiken, kunnen we een afspraak maken. Neem contact met ons op via info@taxadora.com om een tijdstip te boeken.

Als u ons via de chat wilt bereiken, kunt u naar www.facebook.com/taxadora/

Si vous souhaitez nous joindre par téléphone, nous pouvons fixer un rendez-vous. Veuillez nous contacter à info@taxadora.com pour convenir d’un horaire.

Si vous souhaitez nous joindre par chat, vous pouvez visiter www.facebook.com/taxadora/

Om du vill nå oss via telefon kan vi boka en tid. Kontakta oss via

info@taxadora.com för att boka en tid.

Om du vill nå oss via chatt kan du gå till

www.facebook.com/taxadora/