Du fyller i dina uppgifter på vår sida på mindre än 5 minuter.

Har du några frågor så hjälper vid dig via telefon, chat eller e-post.

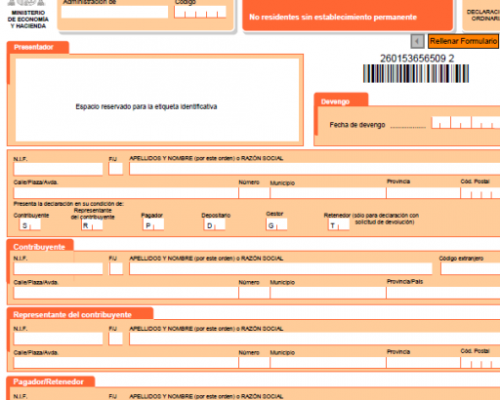

Vi beräknar din skatt, säkerställer att uppgifterna är korrekta och skickar deklarationen till spanska skatteverket.

Vi finns tillgängliga vid frågor, vi pratar svenska.

Du får en kopia på din deklaration från oss och din skatteåterbäring sker till ditt spanska konto.

Om du ska betala skatt istället dras från ditt konto via autogiro av spanska skatteverket.

Du fyller i dina uppgifter på vår sida på mindre än 5 minuter.

Har du några frågor så hjälper vid dig via telefon, chat eller e-post.

Vi beräknar din skatt, säkerställer att uppgifterna är korrekta och skickar deklarationen till spanska skatteverket.

Vi finns tillgängliga vid frågor, vi pratar svenska.

Du får en kopia på din deklaration från oss och din skatteåterbäring sker till ditt spanska konto.

Om du ska betala skatt istället dras från ditt konto via autogiro av spanska skatteverket.

Om du har sålt en bostad i Spanien så har du säkert märkt att du bara fick 97 % av köpeskillingen.

Detta är spanska skatteverkets sätt att inhämta reavinstskatt från utländska fastighetsägare.

När du säljer en fastighet i Spanien så är du skyldig att dels betala en kommunal värdeökningsskatt på mark som brukar kallas ”Plusvalia” och dels en statlig skatt på reavinster.

När du deklarerar den statliga skatten så kan du få tillbaka dessa 3 % om du inte gjort någon reavinst. Det är köparen som har betalat in dessa 3 % i förskott å dina vägnar till skatteverket. De ska också skicka en så kallad ”Modelo 211” till dig som bevis på detta. Om du inte fått det så hör gärna med köparen eller dess advokat.

Om du har gjort en reavinst så är du skyldig att betala in mellanskillnaden mellan skatten och de 3 % som redan betalats in. Skatten på reavinster för Icke-Residenta uppgår till 19 % för EU medborgare.

Klicka gärna på nedan länk så hjälper vi dig deklarera din försäljning.

Skatten på reavinster är 19 % av vinsten. Du har sannolikt redan betalat in 3 % av köpeskilingen via köparen så det är mellanskillnaden du ska betala.

Om du inte gjort någon vinst så får du tillbaka pengar.

Du har tre månader på dig att deklarera din försäljning från att det registrerats vilket kan ge ytterligare en månad.

Vår rekommendation är att göra det så snart som möjligt efter besöket hos notarien för tillträdet.

Ja, du ska deklarera försäljningen både i Spanien och i Sverige. Den spanska skatten är oftast avdragsgill i Sverige. Ta kontakt med oss så går vi igenom din specifika situation.

Du är skyldig att deklarera en försäljningen oavsett om du bor i Spanien eller i Sverige.

Om du inte deklarerar så kommer spanska skatteverket att driva in skatten ändå med strafftillägg.

Det är inte ovanligt att spanska skatteverket utmäter svenska tillgångar via Kronofogden ifall det inte finns kvar spanska bankkonton.

Ja, det ska ni, men en försäljning kan deklareras på samma blankett så ni slipper fylla i allt dubbelt.

Det är den enda spanska skatt som kan samdeklareras när man är icke-resident.

Ja det gör vi om ni vill. Detta är en skatt som oftast betalas av köparen eller så ordnas betalningen av advokaten i samband med försäljningen så den behöver inte alltid deklareras. Ta kontakt med oss om ni är osäkra så hjälper vi er även med detta.

Vårt arvode för att deklarera reavinstskatt för en ägare av en bostad är 198 € plus moms.

Om ni är en ägare är vårt arvode 248 € plus moms.

Detta avser vårt arvode för deklaration som Icke-Resident i Spanien. Det vill säga om du sålt din bostad och normalt bor och vistas i Sverige. Uträkningen avser den statliga Reavinstskatten, om ni också behöver deklarera kommunal värdeökningsskatt på mark så tillkommer detta. I många fall som Icke-Resident är ni inte skyldiga att betala detta eller så har köparens advokat deklarerat det så ni behöver inte bekymra er om det.

I vissa fall avtalar man om att köparen betalar kommunala skatter vilket gör att det inte alltid behöver deklareras.

Modelo 600 är en blankett för att betala in en transaktionsskatt när du köper en bostad.

If you wish to reach us by chat, you can go to www.facebook.com/taxadora/

Wenn Sie uns telefonisch erreichen möchten, können wir einen Termin vereinbaren. Bitte kontaktieren Sie uns unter info@taxadora.com, um einen Termin zu buchen.

Wenn Sie uns per Chat erreichen möchten, besuchen Sie bitte www.facebook.com/taxadora/

Als u ons telefonisch wilt bereiken, kunnen we een afspraak maken. Neem contact met ons op via info@taxadora.com om een tijdstip te boeken.

Als u ons via de chat wilt bereiken, kunt u naar www.facebook.com/taxadora/

Si vous souhaitez nous joindre par téléphone, nous pouvons fixer un rendez-vous. Veuillez nous contacter à info@taxadora.com pour convenir d’un horaire.

Si vous souhaitez nous joindre par chat, vous pouvez visiter www.facebook.com/taxadora/

Om du vill nå oss via telefon kan vi boka en tid. Kontakta oss via

info@taxadora.com för att boka en tid.

Om du vill nå oss via chatt kan du gå till

www.facebook.com/taxadora/