Have you received a letter from the Spanish tax authorities and you do not know what it says?

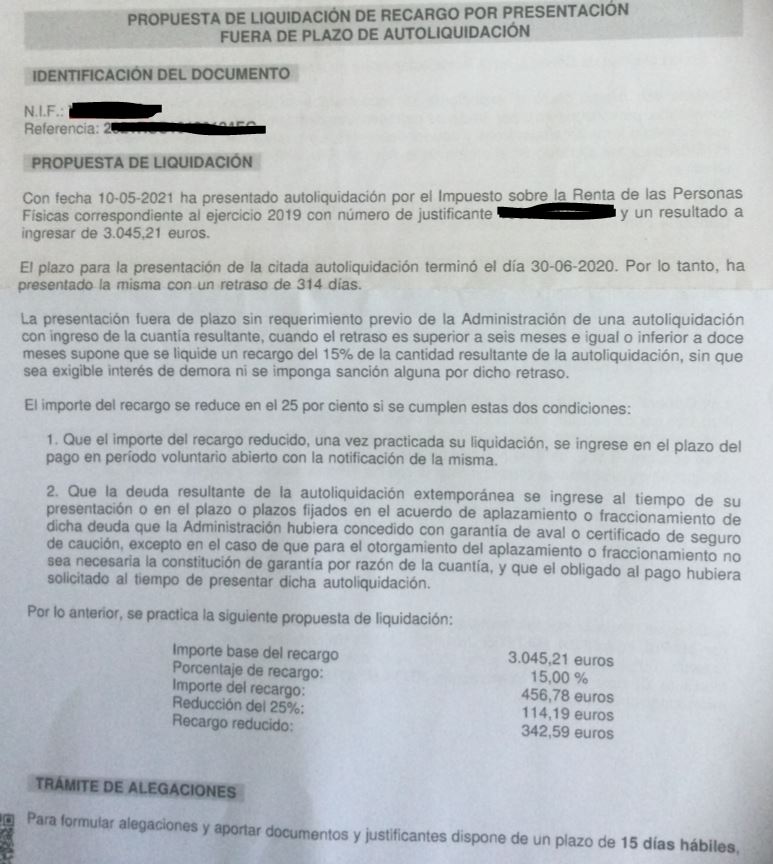

Does it look like the picture below?

In that case, it refers to a proposal for a late payment fee regarding a late submission of a declaration.

If the letter does not look like below, feel free to send us a photo to info@taxadora.com and we will help you.

Continue reading below the picture of what you need to do.

Do not worry. These letters are quite common and of course it is not fun with a late payment fee, but as long as you pay within a reasonable time, no one will seize your house or bank account.

The size of the delay fee depends on a) how late you are with your declaration, b) if you pay the delay fee on time.

The proposed amount is under “Recargo reducido” which will be your fee if you do not dispute fees and pay it on time.

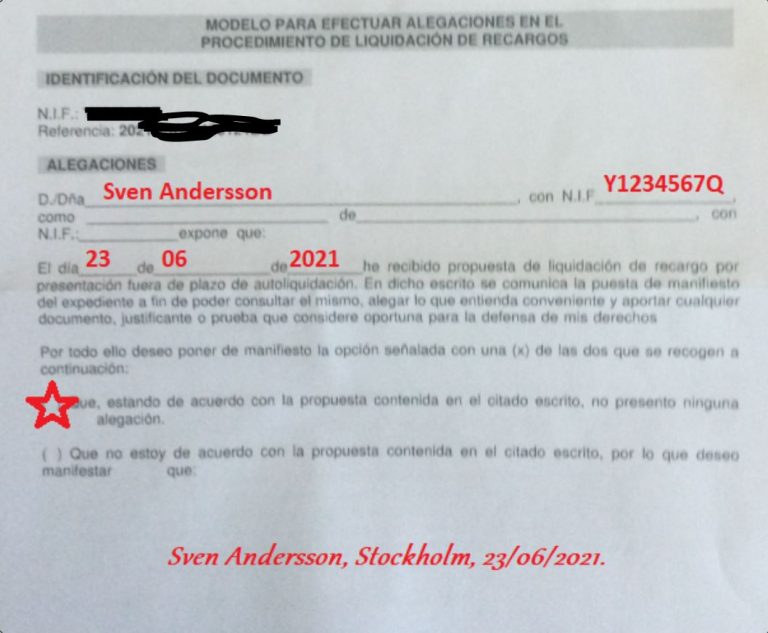

Along with this page, you have probably received a number of pages with complicated legal texts. The page that is important is the one that looks like the following:

You normally have 10 or 15 banking days to respond to the proposed fee. You have the opportunity to accept or dispute. Most of our customers who received this letter have received it because they simply failed to pay their taxes, sometimes for several years in a row. It is thus wise in 99% of cases to accept the proposal for a fee, which results in a reduction in the fee.

Please follow the below steps on how to proceed, you will need some focus and patience but it usually only takes a few minutes to do it.

1. You do this by filling in your name, NIE number, date and tick “Que, estando de acuerdo …” according to the picture above where we put out the star.

You then need to sign with your signature, place and date, which you can either do on the same page as above or on page where there is usually a line for signature.

2. Take a photo of the signed document and save it on your computer.

3. When you are done, click on the below link to send it to the tax authority.

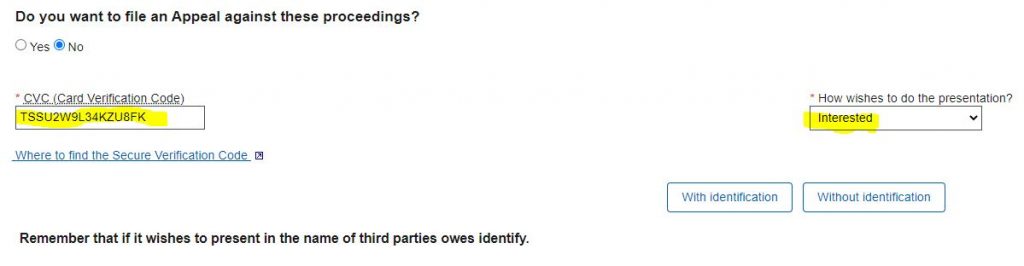

https://www2.agenciatributaria.gob.es/wlpl/REGD-JDIT/FGCSV

You will find a “CSV-code” – Codigo Seguro de Verificacion in very small text at the bottom of the first page of the letter you have received.

a) Fill in your CSV code according to yellow mark in the below picture.

b) Choose “interested”

c) Click “Without identification”

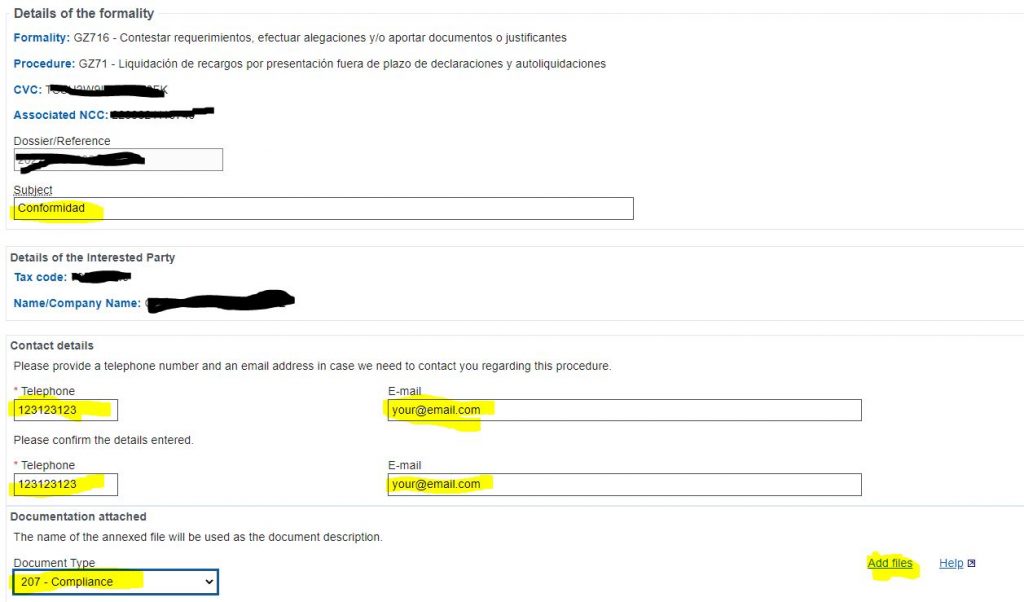

You will now reach the next page which looks like the below picture.

Please fill in accordingly:

Subject: Conformidad

Telephone: you need to add a Spanish number (they will not call you)

E-mail: (your e-mail / optional)

Choose “Compliance” from the list or “Conformidad” if your page is in Spanish.

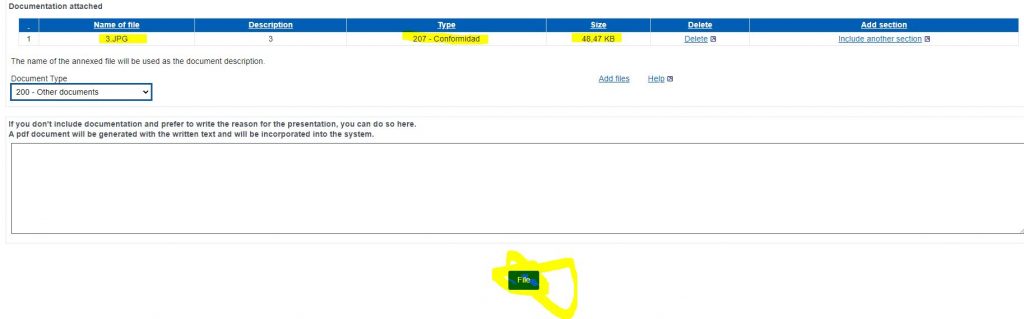

Click “add files” down in the right and choose the saved file from your computer with the signature page.

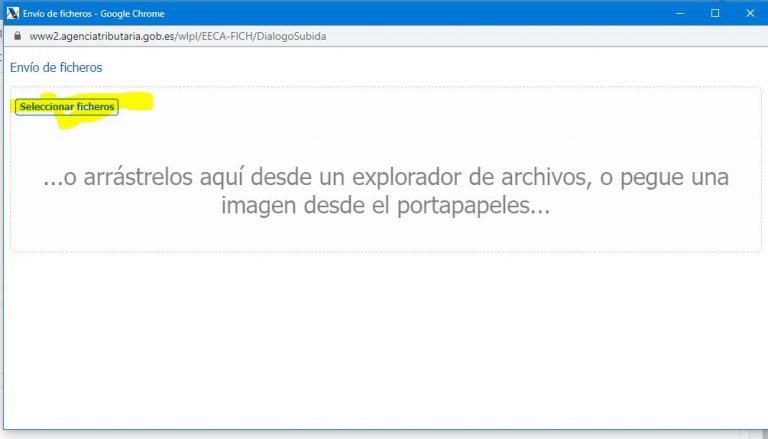

Click “Seleccionar ficheros” to choose the file you have saved on your computer.

You can now see the file you have uploaded, please click “File” to continue.

You are almost done, the last step is to click “Send”.

You are done and within about 2-8 weeks the tax office will send you an invoice by post. This invoice usually contains the fee amounts and says “Modelo 010” or similar with a barcode. It will be sent to your home country postal address.

4. You can pay with the invoice(= “carta e pago”) by sending it to your bank contact in Spain or if you happen to be in Spain by visiting any bank (even if you are not a customer). If you visit a bank other than your own, it is possible to pay with e.g. credit card at the bank.

If you have any problems or are unsure, feel free to contact us at info@taxadora.com with a photo of the documents.

send us a photo of the document with signature to info@taxaradora.com and the “CSV code – Codigo Seguro de Verificacion – which appears in very small text at the bottom of the first page of the letter.

We will then send this to the tax office and within about 2-4 weeks the tax office will send you an invoice by post. This invoice usually contains the fee amounts and says “Modelo 010” or similar with a barcode.

3. You can pay with the invoice(= “carta e pago”) by sending it to your bank contact in Spain or if you happen to be in Spain by visiting any bank (even if you are not a customer). If you visit a bank other than your own, it is possible to pay with e.g. credit card at the bank.

If you have any problems or are unsure, feel free to contact us at info@taxadora.com with a photo of the documents.

If you wish to reach us by chat, you can go to www.facebook.com/taxadora/

Wenn Sie uns telefonisch erreichen möchten, können wir einen Termin vereinbaren. Bitte kontaktieren Sie uns unter info@taxadora.com, um einen Termin zu buchen.

Wenn Sie uns per Chat erreichen möchten, besuchen Sie bitte www.facebook.com/taxadora/

Als u ons telefonisch wilt bereiken, kunnen we een afspraak maken. Neem contact met ons op via info@taxadora.com om een tijdstip te boeken.

Als u ons via de chat wilt bereiken, kunt u naar www.facebook.com/taxadora/

Si vous souhaitez nous joindre par téléphone, nous pouvons fixer un rendez-vous. Veuillez nous contacter à info@taxadora.com pour convenir d’un horaire.

Si vous souhaitez nous joindre par chat, vous pouvez visiter www.facebook.com/taxadora/

Om du vill nå oss via telefon kan vi boka en tid. Kontakta oss via

info@taxadora.com för att boka en tid.

Om du vill nå oss via chatt kan du gå till

www.facebook.com/taxadora/