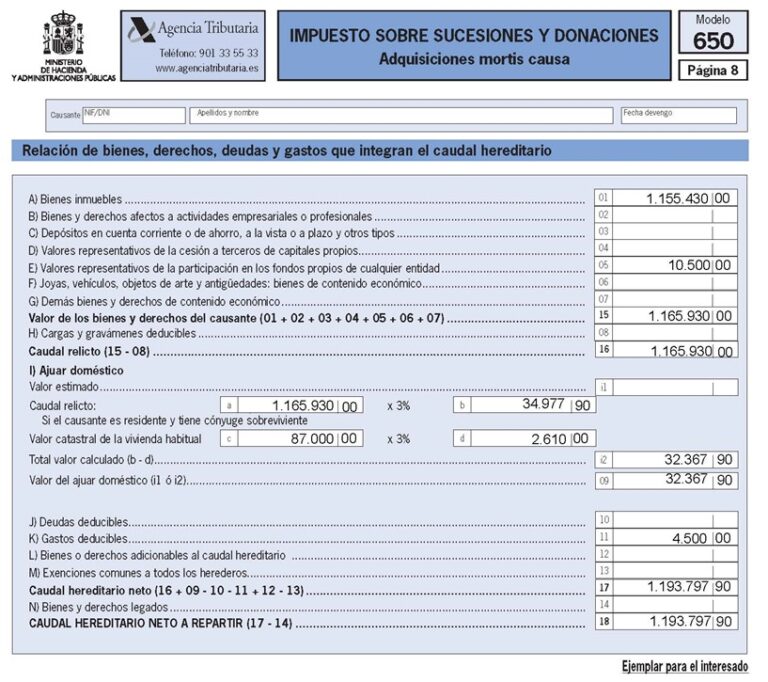

In Spain inheritance and donations/gifts are taxed.

The amount of tax depends on in which region you are living in and there are considerable deduccions in many regions. In many cases you do not have to pay more than a small amount – even though you do have to declare the tax.

If you normally live outside of Spain, you will need to pay for property in Spain, for example a holiday home. If the receiver of the inheritance or donation lives more than half the year in Spain the person will need to pay taxes in Spain even if the property is outside of Spain.

We will help you declare Spanish inheritance and donations taxes and give you the advise you need if you have inherited a Spanish property or plan to give away a donation.

If you wish to reach us by chat, you can go to www.facebook.com/taxadora/

Wenn Sie uns telefonisch erreichen möchten, können wir einen Termin vereinbaren. Bitte kontaktieren Sie uns unter info@taxadora.com, um einen Termin zu buchen.

Wenn Sie uns per Chat erreichen möchten, besuchen Sie bitte www.facebook.com/taxadora/

Als u ons telefonisch wilt bereiken, kunnen we een afspraak maken. Neem contact met ons op via info@taxadora.com om een tijdstip te boeken.

Als u ons via de chat wilt bereiken, kunt u naar www.facebook.com/taxadora/

Si vous souhaitez nous joindre par téléphone, nous pouvons fixer un rendez-vous. Veuillez nous contacter à info@taxadora.com pour convenir d’un horaire.

Si vous souhaitez nous joindre par chat, vous pouvez visiter www.facebook.com/taxadora/

Om du vill nå oss via telefon kan vi boka en tid. Kontakta oss via

info@taxadora.com för att boka en tid.

Om du vill nå oss via chatt kan du gå till

www.facebook.com/taxadora/