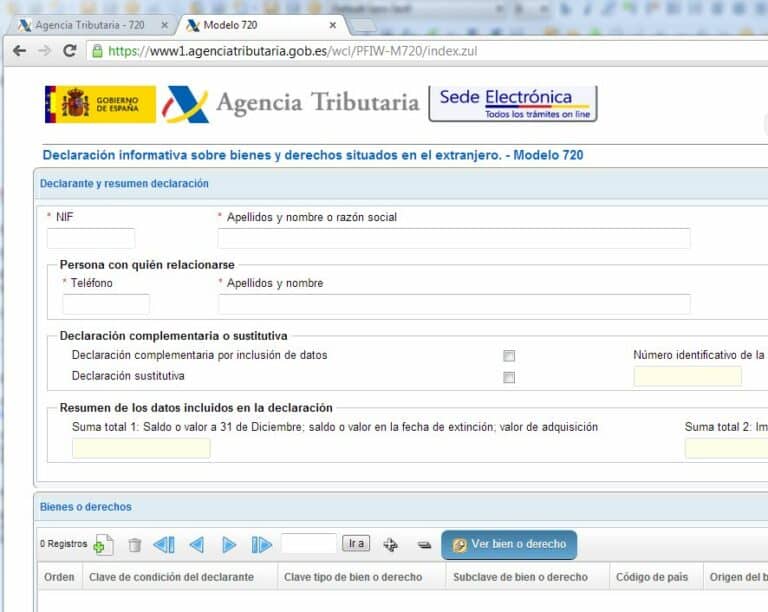

You fill in your tax details on our site in less than 5 minutes.

If you have any questions we will guide you through phone, chat or e-mail.

We calculate your tax, make sure that the information is correct and send your Modelo 720 declaration to the spanish tax authority.

You will receive a confirmation from us. The Modelo 720 is informative and no tax has to be paid.

If you live more than half the year in Spain, you will be considered tax resident in Spain for all your global income.

If you still have bank accounts or own property in your country of origin you will need to declare these assets in Spain, even if this does not mean you have to pay taxes based on these assets.

The Modelo 720 is highly controversial due to heavy fines if you do not declare the assets. It is very important not to miss the Modelo 720 even if it does not mean you have to pay extra taxes.

The aim of the Modelo is to encounter any non disclosed assets or income which might be considered taxable in Spain.

We have automated the process of filing your spanish taxes to make it as easy as possible for you. You fill in your details on our site and we file your taxes for you. We set up direct debit for they payment of taxes so the spanish tax authority will draw the taxes from your spanish tax account. You will receive a confirmation from us and your tax will be paid automatically.

If you prefer, you can make a payment to our client account and we make the payment for you.

We have signed a partnership agreement with the tax authority.

The tax is usually 0,209-0,38 % of your taxable value if you do not rent out your property. If you do rent out your property, you need to declare your rental income and deduct your costs. The part of the year you do not rent your property you will need to pay an “imputed tax”.

For example if you own a property worth 150 000 euro, your tax is probably around 300-500 euro or lower.

We are a network of economists, lawyers and architects. We focus on tax but help clients with a variety of questions about their spanish properties.

We have signed a partnership agreement with the spanish tax authority and are part of an organisazion for spanish tax accountants. We have also a professional liability insurance for the work we do.

Yes, all the information you send to us is encrypted by a similar security that banks use.

We do not have access to your bank account and only use it to set up direct debit for the spanish tax authority. It is only the tax authority who can make direct debit payments from your account. We will never charge your account.

You pay our fees by a debit/credit card.

No, we do not have access to your bank account, only the spanish tax authority can charge your account through direct debit.

You pay our fees through a debit/credit card.

Yes, but you need to make sense of a rather difficult spanish tax system. Rules also change, tax forms can differ from year to year.

There might also be problems with bank paymentss or the property values might have been revised between years. The advice you might have found on internet might not be correct and the advice your lawyer or gestor gave you a few years ago might be out of date.

We quite often see cases where somebody has filed for themselves for years and we notice they have not done it correctly.

The good thing about our service is that you won’t have to worry about that and you have access to support if you have any questions.

We like the analogy that sometimes it’s comfortable to go to a restaurant even if you know how to cook. You won’t need to worry about finding a new recipe or doing the dishes.

But hey, if you love cooking, or doing taxes, you can always spend a few hours making a mess in the kitchen.

Your Valor Catastral is your spanish tax-value of the property. You can find it on your IBI-payment receipt (the municipal property tax). It is Valor Castastral Total which we neeed. I can be also called Valor Catastral / Base Imponible on your IBI-receipt. If you have a newly build house the Valor Catastral might not yet be assiened. In this case, please contant us for more information, info@spanienskatt.se.

You can also take a foto of your IBI-payment, send it to us and we find it for you,

Please click here to find more about IBI and Valor Catastral.

Please contact us and we will find out why. Sometimes this might be due to the fact that your bank has registered your account with the passport number and not your NIE number. This prohobits the tax authority to make the payment. It can also be that the bank has missspelled your NIE or that one of the owners of the property is not account holder “titular”.

Please do contact us if you feel unsure and we will help you.

It is important that the account holder is the person who is the owner of th property. If you are a couple, make sure that the account is in the name of both owners.

You also have the possibility to make the payment to our client account and we make the payment directly. This can be an opcion if only one of you is stated as account holder for the bank account or if you are near a deadline and there is no time to set up direct debit.

Modelo 210 is the Spanish tax form for non-residents. It is valid for persons who do not live in spain but own a property in Spain and need to declare property taxes for the spanish home.

You can read more about it on this link.

If you own a property in Spain, you must declare it in Spain whether you are tax-registered in your home country or Spain. It is a type of state property tax you pay. Often you also pay a local property tax called IBI, you do not need to declare this, but the municipality automatically deducts it after you are registered as the owner of the home.

You must declare no later than December of the year following the tax year. This is true if you do NOT rent out your home. If you rent out your home, you must declare quarterly. The tax is normally deducted on January 21 of the year after you have declared. Ie If you are liable for tax in 2018, you will declare 2019 and your tax will be deducted from your account around January 21, 2020.

Yes, you must declare in both countries, in Spain you declare your Spanish residence even if you are tax resident in other country normally. If you have rental income, you must declare these in both your home country and Spain and make deductions according to the respective countries’ tax system. You can then claim the Spanish tax back in some cases under double taxation agreements so that you do not have to double tax.

If you have never declared although you should have done so, we recommend to declare retroactively four years back in time, which is the period that the Spanish tax authority usually goes back to claim unpaid taxes.

You may be able to pay a penalty for the years you missed but fortunately there are discounts for this if you choose to declare the years you missed. Please contact us for further information.

There are stories online and among friends about people who never bothered to declare and nothing has happened. However, this is erroneous and very risky since the Spanish tax authority has access to both Spanish property registers and European tax information through a joint tax register in the EU. It can thus be expensive and come at the same time as you simply become a tax saver and break the law.

Also, note that there are “discounts” on the fines if you choose to declare earlier years when you missed.

Yes, you both need to declare separately, we help you with this and you get a better price.

Yes! You have to. It is considered a taxable benefit for owning a second home. See it as a state property tax.

Yes, you must declare both income in your home country and Spain. You deduct according to the respective country’s rules and then can claim back the Spanish tax under the double taxation agreement.

You request a tax residency certificate from your home country tax agency. It is a certificate issued by the Tax Agency to certify that you have your tax residence in your country. This means that you are liable to tax in Spain only as a “non-resident” and only pay tax on the assets and income you receive from Spain.

Normally, you need to submit a tax residence certificate the first time you declare. It may also happen that the tax authority demands this. Then you must apply for one on the your home country´s Tax Agency which shows that you are liable to tax in your home country. You then send us the residence certificate to us and we pass this on to the Spanish tax office.

No, you do not normally need to send in your receipts. Modelo 210 is a preliminary declaration stating the income you have had and the costs you feel you are entitled to deduct. If the tax authorities make a different interpretation or request receipts, you will hear from them and then it is important that you have receipts that are approved.

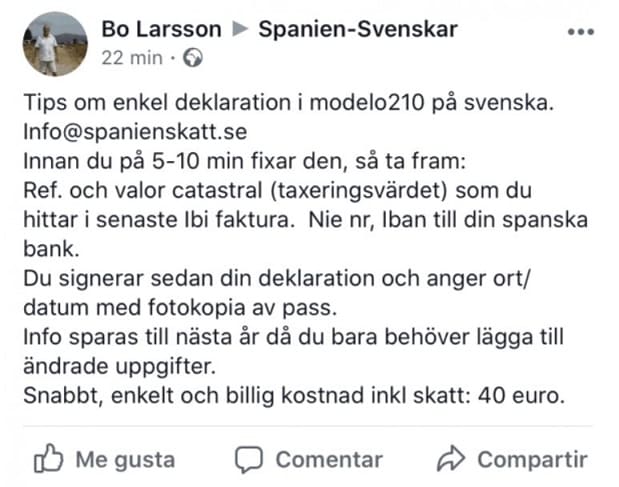

We are your online tax advisor in Spain. Taxadora.com is a service for foreigners in Spain who owns a vacation home and needs to present a Spanish tax return even if they normally have their tax residency in other country.

We help you present and pay your spanish taxes if you own or rent out a property in Spain.

Our service was created after our founder was working for a law firm in Spain helping foreigners with their taxes and property purchaces. The law firm charged over 100 euro to present taxes for the clients and the clients who rented out their property needed to pay this four times a year!

We had earlier experience from the financial industry with similar processes and saw an opportunity to make a better service.

We have been frequent visitors to Spain for more than ten years and decided to develop a service that is cheaper and better than traditional law firms or spanish gestors can offer.

If you wish to reach us by chat, you can go to www.facebook.com/taxadora/

Wenn Sie uns telefonisch erreichen möchten, können wir einen Termin vereinbaren. Bitte kontaktieren Sie uns unter info@taxadora.com, um einen Termin zu buchen.

Wenn Sie uns per Chat erreichen möchten, besuchen Sie bitte www.facebook.com/taxadora/

Als u ons telefonisch wilt bereiken, kunnen we een afspraak maken. Neem contact met ons op via info@taxadora.com om een tijdstip te boeken.

Als u ons via de chat wilt bereiken, kunt u naar www.facebook.com/taxadora/

Si vous souhaitez nous joindre par téléphone, nous pouvons fixer un rendez-vous. Veuillez nous contacter à info@taxadora.com pour convenir d’un horaire.

Si vous souhaitez nous joindre par chat, vous pouvez visiter www.facebook.com/taxadora/

Om du vill nå oss via telefon kan vi boka en tid. Kontakta oss via

info@taxadora.com för att boka en tid.

Om du vill nå oss via chatt kan du gå till

www.facebook.com/taxadora/