If you are a tax resident in Spain, you are required to declare and pay income tax (IRPF – Impuesto sobre la Renta de las Personas Físicas) on your worldwide income. Whether you earn income from employment, self-employment, property rentals, or investments, understanding your tax obligations is crucial to avoid penalties and optimize your tax return.

🚀 At Taxadora, we provide expert tax filing services for residents in Spain, ensuring full compliance and helping you maximize deductions. We also offer tax simulations for individuals who are considering becoming tax residents, so you can understand the impact of Spanish taxation before making the move.

Get Expert Tax Help from Taxadora

You are considered a tax resident in Spain if you meet any of the following conditions:

✅ You spend more than 183 days per year in Spain. ✅ Your main economic interests or business activities are based in Spain. ✅ Your spouse and/or dependent children reside in Spain.

📌 Tax residents in Spain must declare and pay tax on their worldwide income, while non-residents are only taxed on Spanish-sourced income.

🚀 Not sure if you are a tax resident? Taxadora can help determine your residency status and provide a tax simulation if you have not yet moved.

Check Your Tax Residency with Taxadora

Spain has a progressive income tax system, meaning the more you earn, the higher your tax rate. The rates vary by region, as Spain’s 17 autonomous communities apply their own tax brackets. Below is the general national tax scale for 2025:

Taxable Income (€) | Tax Rate (%) |

|---|---|

Up to 12,450 | 19% |

12,451 – 20,200 | 24% |

20,201 – 35,200 | 30% |

35,201 – 60,000 | 37% |

60,001 – 300,000 | 45% |

Over 300,000 | 47% |

📌 Regional Differences: Each autonomous community may apply additional surcharges or deductions, which can affect your final tax bill.

🚀 Taxadora ensures you apply the correct tax rates and deductions based on your region.

Find Out Your Tax Bracket with Taxadora

As a Spanish tax resident, you must declare all forms of income, including:

1️. Employment Income – Salaries, bonuses, and benefits from your job.

2️. Self-Employment Income – Business earnings, freelance work, and professional services.

3️. Rental Income – If you rent out a property, you must declare rental income and applicable deductions.

4️. Investment Income – Dividends, capital gains, interest, cryptocurrency gains, and stock market earnings.

5️. Pensions & Social Security – Retirement pensions from Spain and abroad (subject to tax treaties).

6️. Royalties & Intellectual Property – Income from books, patents, trademarks, or creative work.

7️. Foreign Income & Business Profits – Any income earned from foreign companies or investments.

🚀 Taxadora helps you declare all your income sources accurately and apply any eligible tax deductions.

Start Your Tax Return with Taxadora

If you receive income from another country while living in Spain, double taxation treaties may apply to prevent you from paying tax twice on the same income. However, these treaties are complex and vary by country.

🚀 Taxadora specializes in double taxation issues for private individuals, ensuring you apply the correct exemptions, deductions, and credits to avoid unnecessary tax payments.

📌 We review tax treaties and assist you in claiming tax relief on foreign income.

Speak to a Double Taxation Expert at Taxadora

📌 Filing Period: The annual tax return (Declaración de la Renta) must be filed between April and June for the previous tax year.

How we work:

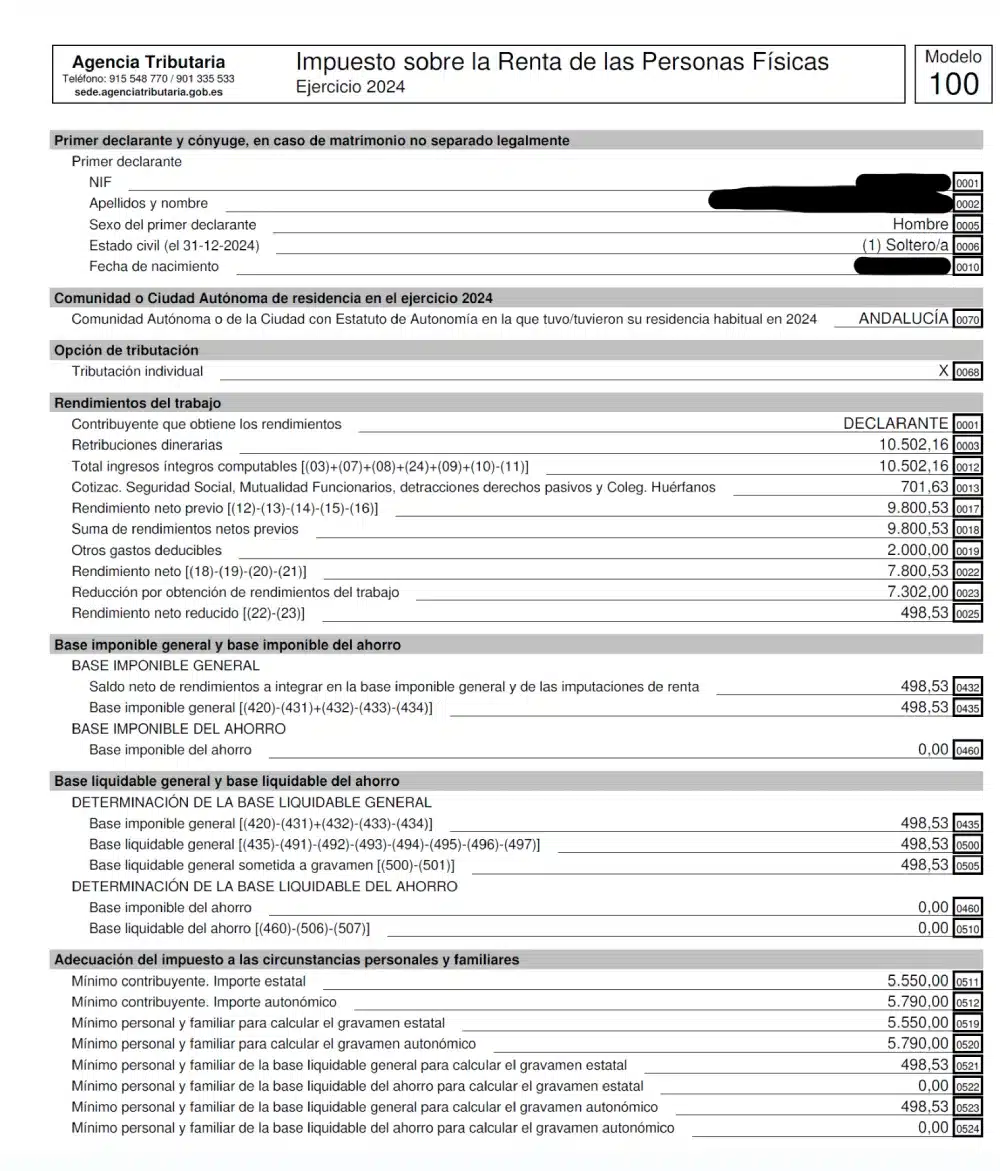

1️. Document Collection: We gather all relevant financial data, including income statements, rental income records, investment statements, and expense receipts.

2️. Tax Calculation & Optimization: Our tax experts apply deductions, exemptions, and credits to minimize your tax liability.

3️. Draft Review: Before submission, we send you a draft of your tax return for approval. 4️. Final Submission: Once approved, we file your tax return directly with the Spanish Tax Agency.

5️. Post-Filing Support: We provide guidance on refunds, tax payments, and audits if necessary.

🚀 Let Taxadora handle your tax return with accuracy and efficiency!

Get Your Tax Return Filed with Taxadora

🚨 Failing to file or filing incorrectly can result in:

📌 Taxadora ensures that your tax return is submitted accurately and on time, avoiding penalties.

Get Help Filing Your Taxes with Taxadora

At Taxadora, we make Spanish tax filing simple and stress-free for residents. Our services include:

✅ Full-Service Tax Filing – From document collection to submission, we handle everything.

✅ Maximizing Tax Deductions – We identify and apply all eligible deductions to lower your tax bill.

✅ Bilingual Support – Assistance in English, Spanish, and other languages.

✅ Double Taxation Expertise – Helping expats avoid unnecessary tax payments on foreign income.

✅ Tax Simulations – If you’re not yet a tax resident, we can provide a simulation of your potential tax situation in Spain.

✅ Draft Approval Before Filing – We send you a tax return draft for review before submission.

✅ Fast and Easy Online Service – File your taxes from anywhere with our expert support.

🚀 Don’t risk fines or overpay your taxes—let Taxadora handle everything for you.

📌 Need help filing your Spanish income tax return? Contact Taxadora today! Get Started

If you are a resident in Spain, you are required to declare your worldwide income and file an annual tax return. Spain’s progressive tax system includes various deductions and allowances, which, if applied correctly, can help reduce your overall tax bill.

💡 Taxadora makes filing your Spanish income tax simple, efficient, and hassle-free!

📌 Need assistance with your tax return? Contact Taxadora today! Start Here

Contact us for assistance with a wide range of tax procedures, tailored to your needs