Spain continues to be one of the top destinations in Europe for foreign property buyers. Whether you’re purchasing a holiday home, retiring under the sun, or investing in real estate, the Spanish property market offers great opportunities—but it also comes with legal, tax, and administrative challenges. In this guide, we’ll walk you through everything non-residents need to know about buying property in Spain in 2025.

Yes, absolutely. There are no restrictions for foreigners buying property in Spain. Whether you’re an EU citizen or from outside the EU (like the UK, USA, or Canada), you can legally purchase residential or commercial real estate in Spain.

However, non-residents must follow certain tax and legal steps, especially if they plan to rent out the property or become Spanish residents.

You’ll need a NIE (Número de Identificación de Extranjero) before you can buy property. This is your tax ID in Spain and is required for all legal transactions.

Most payments related to the purchase (deposit, taxes, notary fees) must be made from a Spanish bank account.

Work with a reputable real estate agent, especially if you’re buying remotely. Make sure to visit the property in person or have someone trustworthy inspect it.

Hiring an independent lawyer is crucial to review contracts, check property debts, confirm legal ownership, and represent you at signing if needed. The best option is to find a lawyer who has NOT been recommended to you by the broker who is interested of finalizing the sale.

This contract removes the property from the market while your lawyer does due diligence. A small deposit is paid (usually €3,000–€6,000).

A 10% deposit is typically paid at this stage. If the buyer pulls out, they lose the deposit. If the seller pulls out, they must return double.

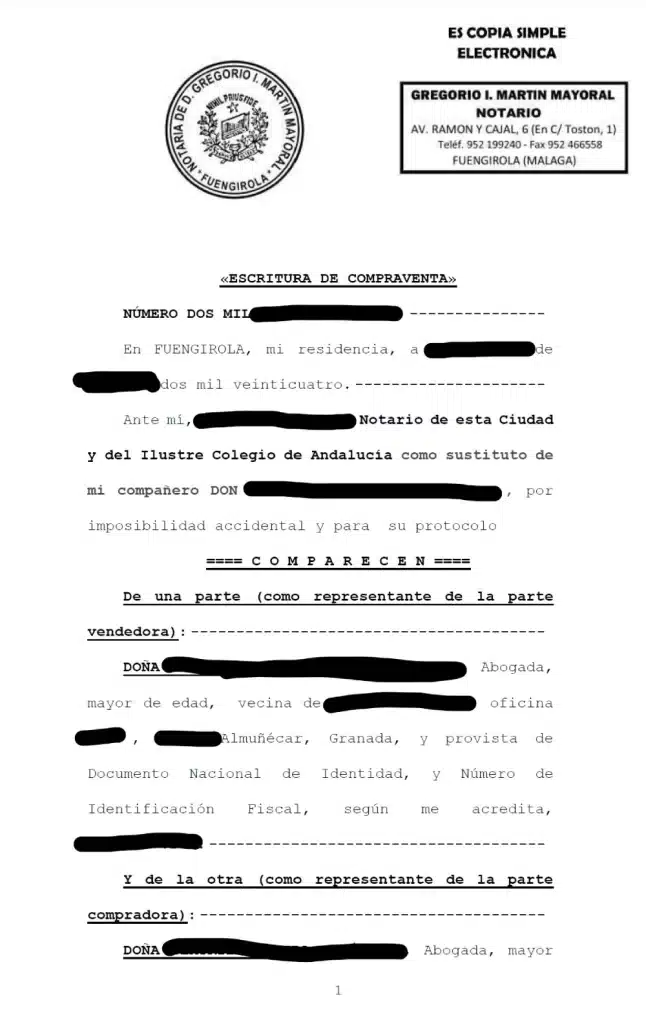

The final deed (“Escritura de Compraventa”) is signed in front of a notary. The balance of the purchase price and all associated taxes and fees are paid.

Your lawyer or gestor will register the deed with the Spanish Land Registry (Registro de la Propiedad).

Besides the property price, budget around 10–14% extra for taxes and fees:

Even if you don’t live in Spain, owning property there may subject you to:

Spanish banks do offer mortgages to foreigners. Conditions depend on your nationality, income, and the property value:

Previously a Golden Visa program existed but it was somewhat controversial and shut down by the Government in 2025. The Golden Visa would in some cases qualify you for a Visa if you invested at least €500,000 in Spanish real estate. The Golden Visa, used to grant you and your family residency rights. EU-nationals do not usually need a Visa to buy a property in Spain so it has rarely been an issue.

At Taxadora, experts in spanish tax forms, we help non-residents navigate the Spanish taxes from start to finish. Once you have found your dream home, you have to yearly file the non-resident tax return and if you receive rental income you also have to file a separate tax return for the income. In some regions Wealth tax may apply even for Non-Residents. If you finally decide to move to Spain permanently, we are happy to help you with your income taxes. We make sure you stay compliant and avoid costly surprises.

Buying property in Spain as a foreigner can be a smooth and rewarding process when done right. Always work with independent professionals, understand the tax implications, and take your time.

For more guidance on Spanish property tax, NIE applications, or non-resident income tax, visit our blog or get in touch today.

Expert in international taxation for private individuals. He combines deep advisory experience with a passion for building technology that simplifies the complexities of Spanish tax compliance. As the founder of Taxadora, he’s on a mission to modernize cross-border taxation with smart, accessible solutions.

Contact us for assistance with a wide range of tax procedures, tailored to your needs