Valor Catastral –

what is it and how do I find it?

The Valor Catastral (Cadastral Value) is a crucial factor for property owners in Spain, as it determines various property-related taxes such as IBI (Property Tax), Non-Resident Income Tax, and Capital Gains Tax. However, many property buyers and owners are unaware of its significance or how to find it.

In this guide, we explain what Valor Catastral is, how it is calculated, and where to find it, ensuring you stay informed and compliant with Spanish tax regulations. If you own a property in Spain, Taxadora can help you manage your tax obligations efficiently.

🚀 Need help finding your Valor Catastral? If you’re having trouble locating it, contact us at info@taxadora.com, and we will assist you. You can also leave the Valor Catastral field blank in our tax form, and we will reach out to help you obtain it.

What is Valor Catastral?

Valor Catastral is the official property valuation assigned by Spain’s Catastro Office (Dirección General del Catastro). It is not the market value but rather an administrative value used to calculate various property taxes.

🚀 Key Points About Valor Catastral:

- It is determined based on factors such as location, property type, size, condition, and market conditions.

- It is generally lower than the market value to ensure fair taxation.

- Each property has a unique cadastral value recorded in the Catastro database.

How is Valor Catastral Used for Property Taxes?

The cadastral value is essential for calculating several taxes, including:

- IBI (Impuesto sobre Bienes Inmuebles – Property Tax)

- An annual municipal tax based on a percentage of the cadastral value.

- Rates vary by municipality but typically range from 0.4% to 1.3%.

- Non-Resident Income Tax (Modelo 210)

- If your property is not rented out, tax is based on 2% of the cadastral value or 1.1% depending on the year and municipality, we will check this for you.

- 19% tax rate for EU/EEA residents, 24% for non-EU residents.

- Important: The Valor Catastral is divided into Land Value (Suelo) and Construction Value (Construcción), which determines eligible deductions for rental income tax.

- Capital Gains Tax (CGT) on Property Sales

- The cadastral value helps establish the original purchase value for CGT calculations.

- The tax is 19% for EU/EEA residents and 24% for non-EU residents on the gain from the sale.

- Plusvalía Municipal (Local Land Value Increase Tax)

- This tax is levied on the increase in the cadastral value of the land when a property is sold.

- It varies by municipality and is based on how long the property has been owned.

- In you deed from purchasing the property “the escritura” that was signed at the notary. If you have the deed in a pdf file (it is often +50 pages long) you can send us a copy and we can search for the tax value for you as it can be difficult to read yourself.

📌 Understanding the Valor Catastral is crucial for accurate tax calculations and compliance.

How to Find the Valor Catastral of a Property

You can check the cadastral value of a property using these methods:

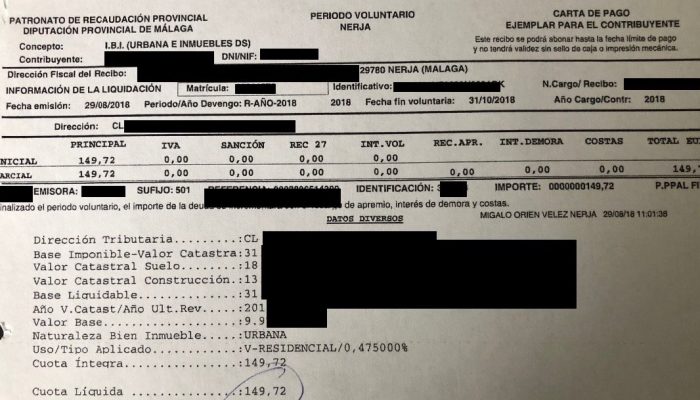

- IBI Bill (Annual Property Tax Receipt)

- The cadastral value is listed on your yearly IBI tax statement issued by the town hall.

- Online via Catastro Website

- Visit Spain’s Catastro Office and search using your property’s details.

- At the Town Hall (Ayuntamiento)

- You can request a Cadastral Certificate (Certificado Catastral) in person.

- Notary or Land Registry (Registro de la Propiedad)

- The Valor Catastral is also listed in property deeds (Escritura Pública) and land registry extracts (Nota Simple).

🚀 Need help? Contact info@taxadora.com, and we will assist you in finding your cadastral value.

Frequently Asked Questions

- What is the difference between Valor Catastral and Valor de Referencia?

- Valor Catastral is used for property taxes (IBI, non-resident tax, capital gains tax, etc.).

- Valor de Referencia was introduced in 2022 and serves as the minimum taxable value for property transactions and inheritance tax.

- Key Difference: Valor Catastral is usually lower than the market value, while Valor de Referencia is closer to real market prices.

- Can the Valor Catastral change?

- Yes, it can be updated due to periodic government reviews, property renovations, or corrections.

- If you think your Valor Catastral is incorrect, you can appeal through the Catastro Office.

- What if I can’t find my Valor Catastral?

- Contact Taxadora at info@taxadora.com, and we will help you retrieve it. You can also leave the Valor Catastral field blank in our tax form, and we will reach out to assist you.

- How does Valor Catastral affect my rental income tax?

- If you rent out your property, the land value (Suelo) and construction value (Construcción) are used to calculate deductible expenses for non-resident rental income tax.

How Taxadora Can Help

Managing taxes based on Valor Catastral can be complex, but Taxadora simplifies the process for property owners in Spain.

✅ Our Tax Services Include:

- Non-Resident Tax Filing (Modelo 210) – Hassle-free tax filing for foreign property owners.

- IBI Tax Assistance – Ensuring accurate property tax payments.

- Capital Gains Tax & Plusvalía Calculations – Optimized tax planning when selling a property.

- Tax Optimization & Compliance – Ensuring you only pay the correct amount of tax.

📌 Own property in Spain? Let Taxadora handle your tax filings! Start Here

Conclusion

The Valor Catastral (Cadastral Value) is essential for property taxation in Spain. It determines IBI, non-resident tax, capital gains tax, and plusvalía municipal tax.

💡 Understanding and tracking your cadastral value ensures you pay the correct taxes and avoid penalties.

📌 Need help with your Spanish property taxes or finding your cadastral value? Taxadora makes it easy! Contact us at info@taxadora.com or leave the field blank in our tax form, and we will assist you. Learn More

Spain Non-Resident Tax Services in Just Minutes

Taxes for Non Residents

Tax Filing for Residents in Spain, Made Easy

Taxes for Residents

Contact us for assistance with a wide range of tax procedures, tailored to your needs

Find us here

- Calle Maestranza, 29016 Málaga, España

- Telephone: +34 611 629 317

- E-mail: info@taxadora.com

-

Opening times for advice on phone or through chat.

Monday-thursday 10.00-18.00

Fridays 10.00-15.00

If we are not available through phone or chat send us an e-mail and we will always respond shortly.

General Conditions | Data Proteccion, Cookies and integrity policy. Spanish VAT nr ESY6837028Q.